Cross-Sell Quarter 3 Market Analysis

/ 0 Comments / in Interesting Insights, market analysis, Automotive Trends, MarketIntel, Automotive Data / 3 min. read / by Admin

As with many industries across the United States, the automotive industry has been rocked by COVID. We’re still adapting to all of the changes, but we learn more with each day.

During the early months of quarter two, many industry leaders and professionals made predictions for the third and fourth quarters.

As the industry’s most respected resource for automotive market data and reporting, we thought we’d break down our Q3 MarketIntel data to see how accurate those predictions turned out to be.

Prediction 1: Auto sales will be depressed in the third quarter

Back in May, Autoblog shared their article, With unprecedented deals, auto industry lures locked-down consumers in which they compared the current and ongoing COVID19 economy to the Great Recession.

By historic accounts, Autoblog found that after the Great Recession, “auto sales rebounded faster than the economy at large, en route to a historic run of industry highs” and claimed that “if consumers can return to work and brick-and-mortar business reopen, car sales may pick up toward the end of the year.”

While still optimistic, Autoblog recognizes that “There are signs, however, that jaw-dropping consumer incentives — from deferred and excused payments to zero percent interest for up to 84 months — are having an effect and propping up sales in some markets.”

They cautioned readers, “ … through the second and third quarter, we’ll still see sales depressed.”

Now that we’ve moved through the second and third quarters, did we end up seeing depressed sales?

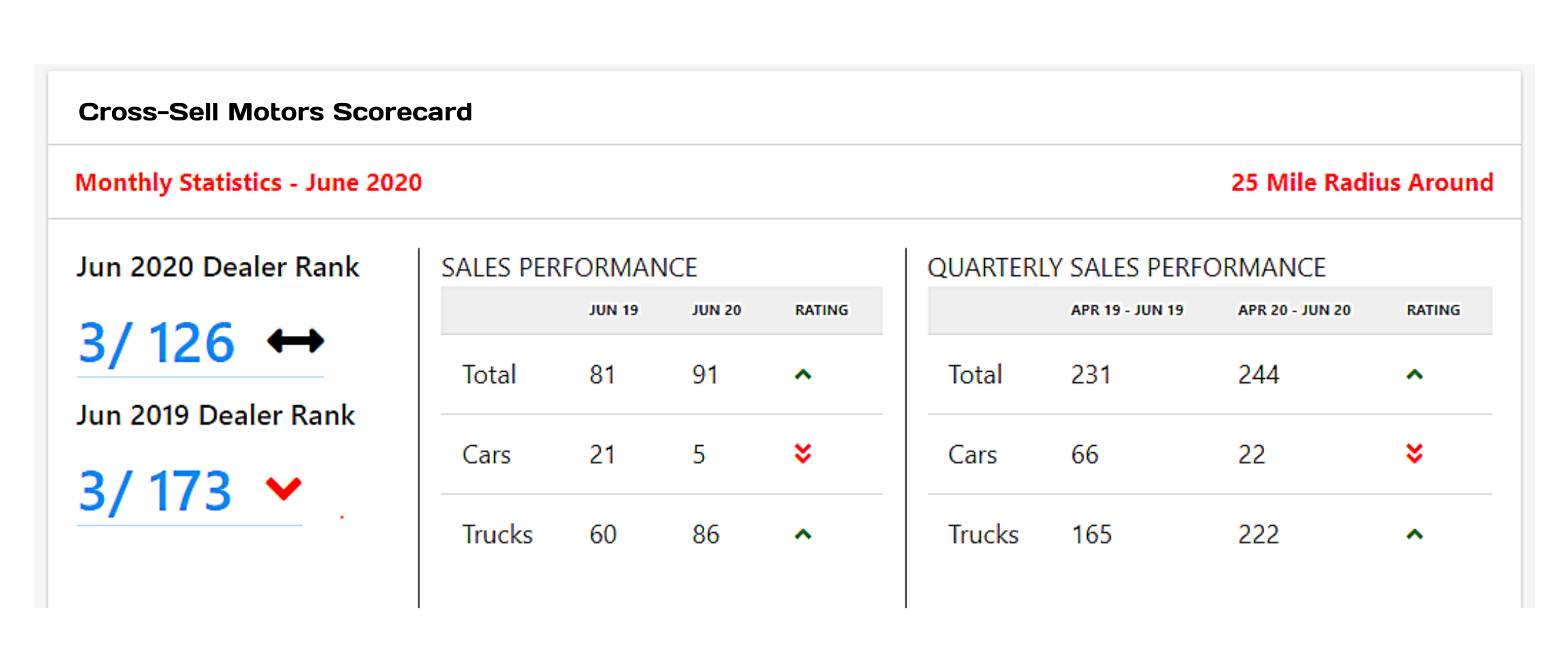

Cross-Sell Report

After reviewing the Q3 automotive industry sales data from our database consisting of metrics from 24 states, we found that sales increased from 6,474,527 in Q2, to 8,955,493, in Q3. That’s a surprising 38% increase in sales for the quarter. Also, our analysis also showed that Q3 2020 only dropped 1% from Q3 2019 sales.

Why did this happen? We hypothesize that the answer lies in travel restrictions and stay at home orders. Since people are eating out less, seeking less outside entertainment, and limiting travel, there’s been little incentive to spend income typically reserved for fuel and free time. With some extra cash lying around, more people have decided to take advantage of incentives and put that income towards a new vehicle.

Prediction 2: 2020 annual vehicle sales drop more than 20%

In a July 2020 report titled US car sales just had their worst quarter since the Great Recession, CNN highlights professional predictions about the future of the automotive industry.

- “General Motors, the largest US automaker, saw a 34% sales drop. Last week GM announced it will cut 700 jobs at a Tennessee plant later this summer because of the drop in demand for the SUVs built there. Still, GM (GM) said sales fell most sharply in April and showed signs of recovery in May and June.”

- “Fiat Chrysler (FCAU) reported a 39% decline in revenue, pointing to the drop in rental fleet sales. Rental car companies typically buy about 10% or more of US car sales in the course of a normal year.”

- “Toyota (TM) also reported a 35% drop in second-quarter US sales, although it saw an improvement as the quarter progressed. June sales were off 22%, the company said.”

Within all of these foreboding statistics and executive claims, there are several predictions about the industry beyond the third quarter. Auto research firm LMC predicts “a 33% drop in sales in the quarter and a 22% drop over the course of the full year.”

In the face of understandable pessimism, what does our database forecast for the rest of 2020?

Cross-Sell Report

Comparing the year so far to 2019, we’re seeing an overall drop of 11%. If Q4 performs equal to or better than Q3, we could see an annual drop of less than 10%. That’s far better than the predicted 22% annual drop from LMC. It’s not the preferred starting point for 2021, but it’s much better than we expected, given all that’s gone on this year.

Want More On Q3 2020?

By cross-referencing these predictions with the Cross-Sell Quarter 3 MarketIntel Analysis, we were able to determine the accuracy of some of the auto industries’ biggest players.

While the information here gives us a good birds-eye view of the market, the. Cross-Sell’s Q3 MarketIntel presents detailed analytics for states and local markets, featuring competitive insights and market trends.

In an industry at the mercy of an ever-evolving pandemic, there’s no shortage of uncertainty for the future.

If you value the security of granular market analytics and insight into your competitors’ decisions, then pick up your copy of the Cross-Sell Q3 MarketIntel Report now.

Cross-Sell Q3 Market Analysis

Cross-Sell Q3 Market Analysis

Leave a Reply

Want to join the discussion?Feel free to contribute!